Dear Stylists, 4 Smart Ways To Protect Your Income

Here’s How To Protect Your Annual Income As A Hairdresser

Cosmo school usually covers the basics, but chances are your program didn’t teach the ins and outs of financial literacy. Finance can be intimidating, but here’s the truth: Even though money is often a taboo subject in the industry, open discussions and education can help everyone succeed.

Ulta Beauty Senior Director of Education & Creative and Certified Finance Educator Anna Manukyan (@amanukyan) is teaching hairdressers how to take control of their financial future on BTC University. Watch the full class and snag a few tips below to get started!

The financial security pyramid has 4 essential parts.

Listed from bottom to top in order of importance, Anna explains that these financial factors MUST be balanced. Why? If you have tons of investments but zero protection, you’ll have nothing to fall back on if your investments fail. Or, if you put every penny earned into paying off debt and never grow your emergency fund, you’ll slide right back into debt when something unexpected happens.

1. Protect your finances by defining your assets.

The first step to financial protection is asking yourself what your assets are. So, what are assets? Assets can be cash, cash equivalents, investments and personal use assets. But, the most important asset is YOURSELF! Which is why life insurance can be especially helpful.

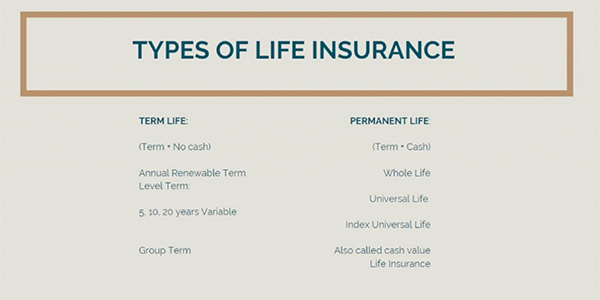

There are two major policies Anna recommends looking at:

Term-based insurance:

- Is usually inexpensive at the start

- Won’t usually require a health report from your doctor

- Follows “use it or lose it” guidelines when it comes to coverage

- Will expire at the end of the term

- Has a significantly higher rate once renewed

Permanent insurance:

- Does not expire

- Has a steady rate

- Usually works as an “investment” wherein money accumulates for you to use as needed

- Can include long-term care depending on the policy

Whichever policy you prefer, Anna advises considering life insurance when you are at your youngest and healthiest for the lowest possible rate.

2. Tackle debt with small, realistic goals to make it more manageable.

Debt is a part of everyone’s lives in some way or another, and there’s no shame in having it or learning how to manage it. Anna explains that small, consistent goals can help manage debt without depleting other financial necessities. Think of a small sum that can be contributed toward debt management from every paycheck.

If you have different areas of debt that accrue interest, Anna also recommends targeting smaller sums first since they are easier to get rid of. That way, the interest won’t sneak up on you over time.

Want more budgeting tools to protect your income? Enroll in BTC-U for unlimited access to business-centric classes like Anna’s for retirement tips, investment tax strategies and more!

3. Are your expenses wants or needs?

Emergencies shouldn’t drain your savings (or send you into debt). A designated emergency fund can help alleviate those surprise costs. If putting extra money away stresses you out, Anna has a solution: track your purchases for one month and list each as either a want or a need. This isn’t a call not to “waste” your hard-earned money on things that make you happy. Instead, be intentional with where the money you keep goes.

Pro tip: Anna recommends keeping different accounts for savings, your dream vacation and especially, your protection and retirement funds. Use the 10/20 rule as guideline for how much to save. When it comes to protection, you’ll need ten times your annual income; for retirement, you’ll need 20 times your annual income.

Watch the full course to learn more of Anna’s must-know financial advice!

4. Invest your money as soon as you can in order to grow it over time.

As a rule, the best time to make investments was yesterday; the second best time is today! Even small sums make a huge different. Take a $7 tube of color: Are these purchases coming back to you, or are you getting a return off of them? In other words, is the tube of color worth the investment?

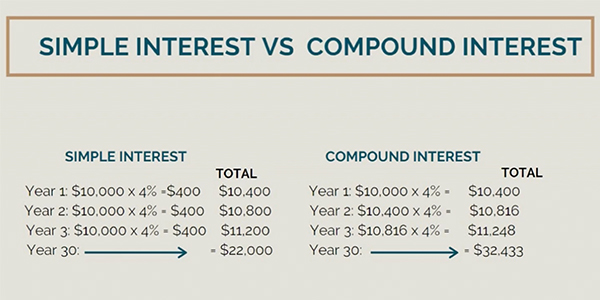

To go a step further, consider opening an investment account at your bank, says Anna. Depending on whether you have simple or compound interest, your money can double in matter of years. Knowing the difference is a real game-changer.

If your money compounds, your interest will always grow more interest!

Pro tip: Use the Rule of 72 to figure out how quickly your investment fund will double! All you need to do is divide 72 by the rate of return you’re expecting to get on an investment. For example, if you have $10,000 with a six percent rate, you can divide 72 by six to find that your investment will double every 12 years.

Watch Anna explain the foolproof Rule of 72!

View this post on Instagram

To watch Anna’s full course about securing your financial future, visit BTC University!

More from

Ulta Beauty

-

Make More Money

6 Things To Never Say When Offering An Add-On Service

-

Chain Salons

IGK’s “Good Behavior Blowout” Now Available at all Ulta Beauty Salons

-

Business

3 Cutting Fundamentals To Relearn For A Booming Business

-

Hair Color

The Bubble Technique: 5 Tips To Create Rainbow Hair Color

-

BTC Hair Trend Report

The Biggest Haircut Trends of 2024

-

Business

New To Budgeting & Investing? Start Here!

-

Business

The Ins & Outs Of Assisting: How To Be & Choose The Right Hair Assistant

-

Curly

Curly Consultation & Haircutting: Watch The Full Tutorial!

-

News

How Maui Hairdressers Are Rebuilding Post-Lahaina Fires

-

Business

How To Make 6 Figures From Stylists Who Actually DID IT

-

BTC Events

AI, Mental Health & Social Media: 7 Business Tips You Can’t Live Without

-

Business

6 Saving & Investing Tips To Grow Your Profit

-

Facebook Lives

Volume Guaranteed: Try This Layering Technique For Fine Hair

-

Bobs

The Biggest Haircut Trends of Summer 2023

-

Industry News

Vernon François Joins Ulta Beauty Pro Team of Industry-Leading Artists & Educators

-

Industry News

6 Award-Winning Hairstylists Join the Ulta Beauty Design Team

-

BTC Hair Trend Report

2023 Hairstyling: 11 Trends You Need To Know

-

BTC Hair Trend Report

2023’s Biggest Haircut Trends

-

Business

5 Steps You Must Take To Build A Strong Salon Culture

-

Beachwaves

6 Tips For Faux Blowouts & Effortless Waves

-

Blonde

The Biggest Hair Color Trends Of Winter 2023

-

Accessories

15 Styling Trends That Will Be Everywhere in Winter 2023

-

Balayage

5 Tips To Upgrade Your Cutting, Blonding & Styling Techniques

-

#ONESHOT HAIR AWARDS

Modern Art