NEW Venmo Tax Law: Are You Filing Correctly?

Have You Made Over $600 on Venmo? You Will Now Be Taxed!

2022 Update: Need help filing your taxes this year? The IRS is reminding small business owners to report any earnings made over $600 on third-party apps (like Venmo, PayPal and Cash App). To help you this tax season, they recently released a useful guide for understanding your form 1099-K to guide you through reporting any earnings. Keep scrolling for everything you need to know about this new rule!

- Venmo business transactions totaling $600 per YEAR will now be taxed, as of Jan. 1, 2022.

- This goes for Zelle, Cash App, PayPal and other digital payment apps.

- That means that any stylist who uses Venmo for their business transactions and gets at least $600 in payments for their services can expect to be taxed on that money.

Find out the best practices, how to save yourself a hefty fee and what you really need to know as a stylist using Venmo.

Disclaimer: For anything related to the accounting and expenses of your business, please talk to your CPA or financial expert. BTC is providing the info below for educational purposes only.

New $600 Tax Threshold for Digital Payments

“The IRS will be able to cross-reference both our reports and yours,” PayPal said in a statement. For stylists, this means you may want to consider how and where you receive your tip payments. PS—Venmo has a tipping feature for businesses to turn on for their business profiles.

For the 2022 tax year, anyone who receives at least $600 in payments for goods and services through Venmo, or other payment apps, can expect to receive a Form 1099-K.

What Is A 1099-K Form?

This is a tax form to report payments for goods and services transactions. Organizations that facilitate these payments, like debit/credit card companies, PayPal, Stripe, Venmo, Etsy, Upwork, and many others, are required by law to file them with the IRS and send copies to the payment recipient.

Expect to hear from Venmo this January! You will receive a notice from Venmo that will allow you to download your forms directly from Venmo’s website.

When Is The Deadline To Confirm My Information To Venmo?

You will report your earnings for 2022 during the 2023 tax season. For Venmo to issue your Form 1099-K in time, you will need your tax info confirmed by 12/31/2022. However, Venmo encourages this to be done sooner than later for users to be able to send, spend and withdraw money from any payments that might be on hold.

How Does Venmo Know Which Transactions Are Business Ones?

Right now, business transactions are supposed to only take place through business Venmo accounts. The Paypal-owned app’s terms of service say that individual users cannot use a personal account for commercial purposes. If you use a personal account for business purposes, you’re at risk of getting your account suspended, or “loss of transaction”—aka, Venmo will literally take that money.

It’s Gonna Cost You—Venmo Is Changing Their User Agreement!

As of July 20, 2021, Venmo’s rules on payment for goods and services changed—financial experts say these changes could hurt small businesses like stylists, nail techs and estheticians. At the very least, you could be paying transaction fees for every service your clients pay for via Venmo. At the worst, your account could be flagged and you could lose transactions entirely.

Keep reading for everything you need to know about Venmo’s payment policies and how much you’ll be paying per transaction starting July 20, 2021.

Business Transactions & Fees On Venmo

Right now, business transactions are supposed to only take place through business Venmo accounts. The Paypal-owned app’s terms of service say that individual users cannot use a personal account for commercial purposes. If you use a personal account for business purposes, you’re at risk of getting your account suspended, or “loss of transaction”—aka, Venmo will literally take that money.

As of July 20, 2021 personal accounts can disclose when they send and receive business transactions. This means a client can check a box in Venmo that indicates their payment to you is for a good or service—and then Venmo will charge you 1.9% plus 10 cents for a transaction fee. You can also indicate that a transaction on your personal account is business-related.

Remember, if Venmo reviews your account and discovers you are accepting personal payments for business transactions, they can take that payment back.

Here’s what Venmo says:

“If you accept a Venmo payment from someone for a good or service via your personal profile (instead of a business profile) and we later review the payment, we may reverse the payment, meaning you could lose both the payment and the item sold. This review process may not occur until after you attempt to transfer the funds out of Venmo.”

What’s The Difference Between Personal & Business Profiles?

In terms of saving you money, potentially nothing. The benefit to a business profile is the Venmo Purchase Protection Program, which helps buyers get refunds if their purchase is disputed.

With the July 20 change, business profile transaction fees are the same amount whether you create a business account or continue to use your personal account and flag individual payments as “business” payments. In both cases, the Venmo fee for a business transaction is 1.9% + $0.10 of your transaction amount.

Venmo Personal VS. Business Profiles: Key Differences

Venmo Personal Profiles:

- Users can send and receive money with family, friends and businesses

- Free to sign up and to send/receive money

- $0 monthly fees

- Option to disclose business transactions for Venmo Purchase Protection Program

Venmo Business Profiles:

- 1.9% + $0.10 fee on every transaction

- Touch-free payment option for customers

- Option to gain customers through “Venmo Spotlight”

- Free to sign up and no monthly fees

- Customizable profile with photos and imagery

- Purchase Protection Program automatic on all transactions

Venmo discloses that users can, “Use your existing Venmo login to access both your business and personal profiles, so you can seamlessly switch from one to the other. Track and organize your business transactions separately from your personal ones for simple bookkeeping.”

Are The Fees Worth Using Venmo?

We’ll break it down. Say you charge $40 for a haircut. Your client sends you the $40 payment plus a $10 tip, for a total of $50, via Venmo and marks the payment as one for a good or service.

Venmo will charge you a seller transaction fee of 1.9% + $0.10, which would be $1.05, to receive payment on that $50. So your client may have sent you $50, but you are only keeping $48.95 of it.

Looking at that from a “busy books” point of view, if you get $50 five times a day via Venmo for services and work four days a week, you’re looking at spending $20+ a week to receive payment for your services through Venmo.

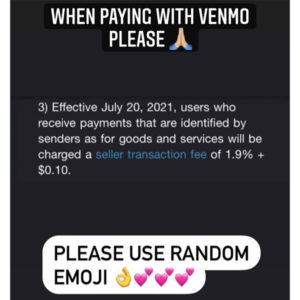

Can Emojis Disguise A Business Payment?

You’ve probably seen Instagram posts of stylists and other service providers asking clients to stop writing “haircut” in the Venmo memo field and instead use random emojis. Why?

Venmo requires you to use the memo field every time you send or request money. Anecdotally, some service providers noticed flags on their transactions that had clear descriptions of the goods or services they provide. The idea is using emojis or animated gifs would “get around” Venmo thinking a charge was for a business.

However, one stylist said Venmo caught on to her and placed her account under review—in the process, her transactions were totally lost. Her clients were using “💇🏼♀️💸” , “✂️💕” and similar emojis, which Venmo flagged as business payments but not on a business profile. Because Venmo doesn’t allow this, she lost that money.

Now, sole proprietors and other small businesses have been circulating posts asking clients to use totally random emojis, random phrases or even disguise payments as “For lunch.”

So will these tricks really “get around” the fees? “It certainly wouldn’t hurt, since Venmo has been cagey about the extent to which it monitors transactions,” according to Slate.com. But with the July 20 update, Venmo will be encouraging clients to flag payment for services themselves—basically putting more pressure on clients to decide whether they want the Venmo Purchase Protection to cover them, or not.

What About Tips?

Same rules apply. If Venmo catches onto anything that looks repeated or “business-like” before July 20, they have the right to confiscate the transaction. Without the business profile security or, after July 20, the disclosure option on personal profile transactions, you risk losing that money.

Can I Still Use Venmo To Receive Payments From Clients?

Of course! Venmo is not changing how we send and receive payments, just cracking down on what type of payments are sent through personal accounts.

You can let your clients know about this policy change and discuss with them what you would prefer to do. You could also consider adding a Venmo service charge to transactions, such as $1.50 per Venmo transaction, to cover your fees.

You may have noticed QR codes displayed on stylist stations recently—these are offered as a touch-free form of payment through Venmo business profiles! You can purchase a QR Kit or personalize your own at home. For more info check out Venmo’s QR Kit here.

How To Set Up A Business Profile

If you already have a personal Venmo account: Look for the “Business Profile” option in your Venmo app’s main menu (☰). If you don’t see this option, make sure you have the latest version of Venmo on your device or check back at a later time.