How Much Do People Spend On Beauty?

Who is Spending on Beauty Services, and How Much Do They Spend?

Knowing how to market to current and potential clients is key to maintaining and growing a healthy business, so we’re here with some data that can help you understand who exactly is ready to spend money on the services you offer. Keep reading to see interesting info like the average beauty client’s age, the metro areas that spend the most (you might be surprised!) and the top service clients want to try next.

This data breakdown comes from the MINDBODY Wellness Index, which measures the strength of wellness marketplaces in a geographic region by analyzing business success factors and consumer behaviors and attitudes in the fitness, beauty and integrated health industries. Nearly 17,000 individuals participated in an online survey, ages 18 to 65, to offer these insights.

1. Most people prioritize—or WANT to prioritize—beauty and grooming services.

Nearly 40% of those surveyed say they do prioritize beauty and grooming services, and another 42% say they try to when they can. In general, men engage in basic grooming more often than women. While women don’t get beauty services as often (about once every three months), they regularly spend significantly more per occasion.

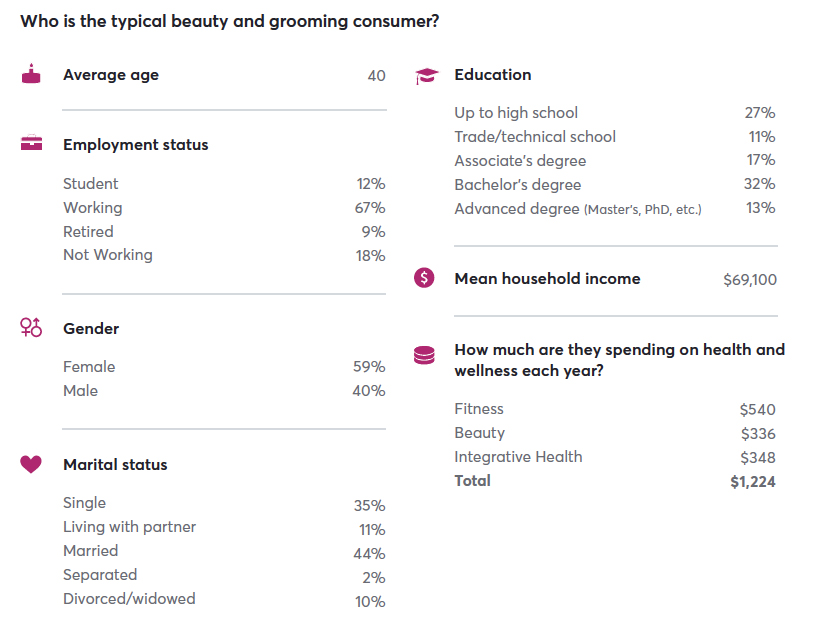

2. This is the typical beauty and grooming client.

The data reveals the typical beauty and grooming client is about 40 years old with a household income of $69,100. This person is willing to spend up to $336 on beauty services each year. They are also more likely to hold an advanced degree.

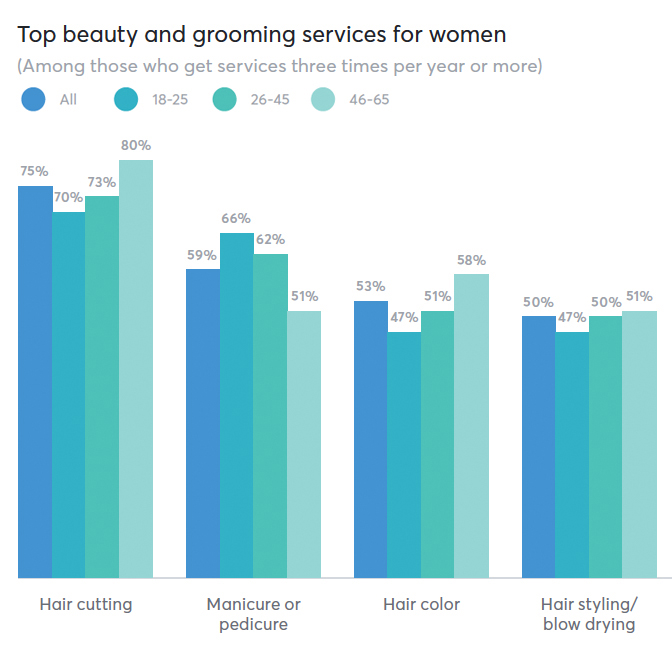

3. Haircutting is the service most women spend money on, followed by manicure/pedicure services and haircolor.

However, the services women use do tend to differ across age groups. While 46-65-year-olds lead in haircutting and haircolor, higher percentages of 18-25-year-olds and 26-45-year-olds get manicure/pedicure services, eyebrow waxing or threading and body waxing.

4. Younger women prioritize beauty services the most, but spend less than other age groups.

Not a complete surprise here—women ages 18-25 want more beauty services and actually spend the highest percentage of their income, but do spend less overall than other age groups.

5. This service is seen as a must-have.

While household income plays a factor in who engages in certain services, demand for hair services is relatively consistent across all household income groups. This suggests that hair is seen as an expense that consumers willingly spend on, regardless of income.

6. The NYC metro area spends the most on beauty services, and Louisville, Ky. area spends the least.

The average yearly spend in the NYC metro area is $638, or $53/month. In the Louisville, Ky. metro area, that drops to about $293, or $24/month.

7. The top 5 metro areas that spend on beauty services are not necessarily the top 5 most populated areas.

Now you know NYC is the top beauty service spender, but the next four might surprise you:

- 2: Miami-Fort Lauderdale-West Palm Beach, FL at $524/year

- 3: Boston-Cambridge-Newton, MA at $478/year

- 4: San Francisco-Oakland-Hayward, CA at $473/year

- 5: Washington-Arlington-Alexandria, DC-VA-MD-WV: $465/year

Nope, not LA, Chicago, Dallas or Houston, which are in the top 5 most populated areas.

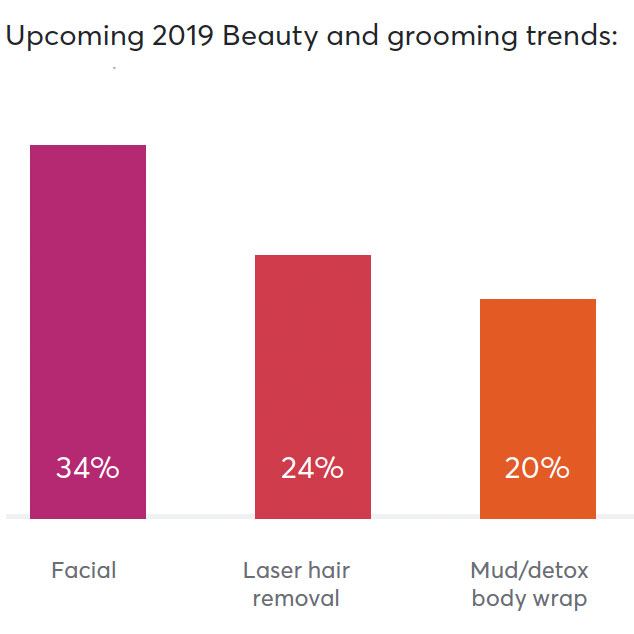

8. Consider adding these services to your salon or spa.

Facials are the top service Americans want to try next—34% said they were interested. Next is laser hair removal (24%), followed by mud/detox body wraps (20%).

9. People who prioritize beauty services are more engaged in other beneficial behaviors.

The more often Americans report pursuing beauty and grooming services, the more likely they are to report positively across the spectrum of healthy habits and attitudes, such as having close relationships, getting regular medical checkups, feeling spiritually fulfilled, engaging in creative and stimulating activities and drinking at least 6-8 glasses of water a day.

10. Time is the biggest obstacle for most people to get beauty services.

No surprise here either—37% of those surveyed cite time as an obstacle to leading a healthy lifestyle. This opens the door for potential fast-tracked services, like express facials. Only 5% of consumers have tried an express facial bar already, but 42% say they would like to try it in the future.